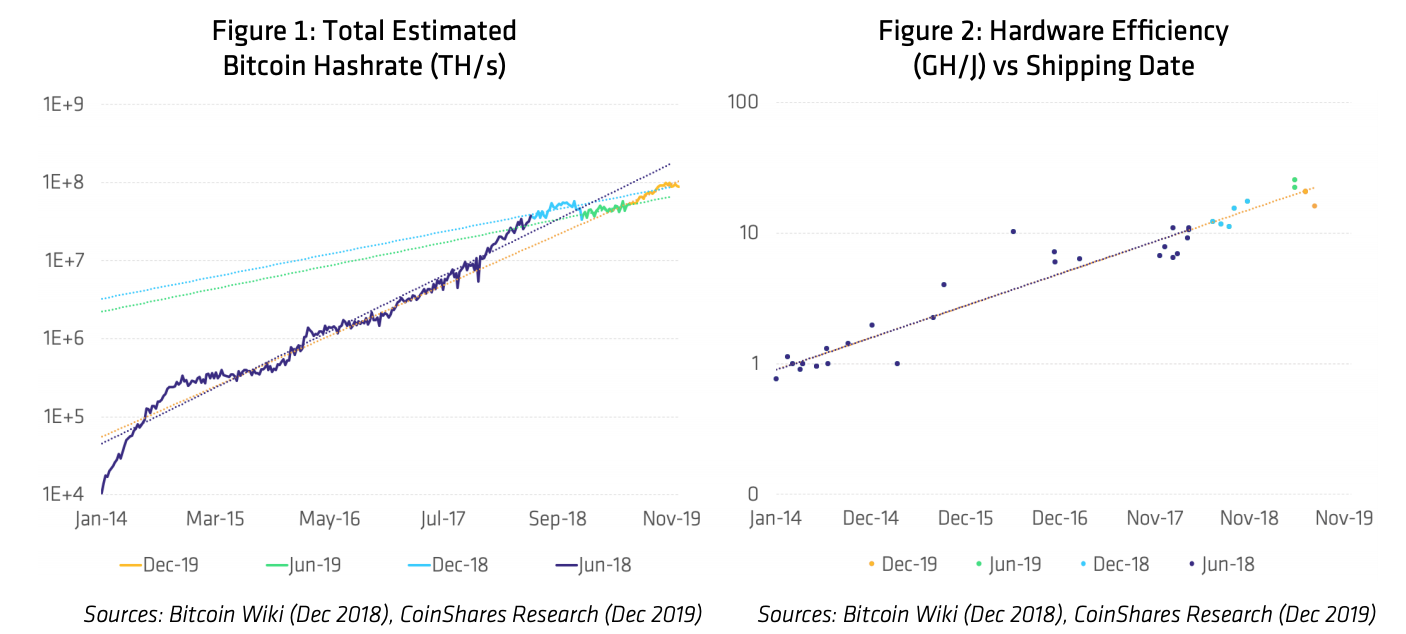

The December 2019 report on the Bitcoin mining network from CoinShares Research, a division of the digital asset management firm, presented an industry in good health at the end of the year, with a hash rate that had almost doubled in the previous six months, a new generation of more powerful and efficient technology on the market and the continued use of sustainable, renewable energy.

The report indicated that, at this year’s average bitcoin price, fee ratio and block frequency, miners were on their way to making $5.4 billion in total revenue for 2019, down slightly from 2018, but significantly up from $3.4 billion accrued in 2017.

“Unlike the period leading up to our previous report, these last 6 months have been relatively calm in terms of large-scale structural changes,” per the report. “Whereas the period between November 2018 and June 2019 witnessed a large number of bankruptcies and capital transfers, the development of the last 6 months has been mainly one of expansion.”

As the bitcoin mining sphere builds on this positive momentum from the end of 2019 and heads into 2020, factors like the increasing hash rate, new hardware, the upcoming reward halving and more will determine how the industry, and Bitcoin in general, grows.

Good News for the Bitcoin Mining Hash Rate in 2020

CoinShares reported a “huge increase” in the mining hash rate which nearly doubled in the last six months from approximately 50 exahashes per second (EH/s) to almost 90 EH/s, having peaked at more than 100 EH/s.

The report attributed this increase to a combination of the availability of a new generation of more powerful, efficient mining equipment and strong average bitcoin prices.

And, even since the reports release on December 3, 2019, the hash rate has continued to climb.

In a recent episode of the What’s Halvening podcast, CoinShares Research Director Chris Bendiksen discussed the increase in hash rate, particularly from Chinese operations, which he said accounted for almost 70 percent of the increase. China now accounts for 65 percent of the global bitcoin mining hash rate.

Bendiksen noted that this increase in hash rate was largely the result of improved technology and, since most new mining computers are produced in China, Chinese miners were first in line in getting next generation technology upgrades.

He expects that, as new technology filters into the Western market, the hash rate there will rise as well.

He also noted that there were signs that as Chinese miners upgraded they were shipping their old Bitmain Antminer S9 mining hardware to places like Iran and Kazakhstan.

Blockstream CSO Samson Mow, whose company has mining operations in Quebec, Canada, and Adel, Georgia, agreed with Bendiksen’s optimistic outlook for 2020.

“Bitcoin’s network hashrate will keep climbing as miners switch out older equipment with newer and more efficient models,” Mow told Bitcoin Magazine.

Will China Continue to Dominate Bitcoin Mining in 2020?

As noted above, the CoinShares report indicated that “as much as 65% of Bitcoin hash power resides within China — the highest we’ve seen since we began our network monitoring in late 2017.”

Despite the growth of bitcoin mining around the world, in places like North America, Russia and the Middle East, China still dominates the industry. Some may view this as a concern, especially as the dominance appears poised to grow entering 2020, as it centralizes one of Bitcoin’s most critical industries.

For Mow’s part, China’s dominance is certainly something to note, but ultimately he believes it is “a non-issue.”

“I wouldn’t be concerned about China’s dominance in Bitcoin mining,” Mow said. “The main advantages of mining in China are faster setup times and lower initial CapEx which, along with closer proximity to where ASICs are assembled, have driven industry growth there … Now that we have mining infrastructure built up in North America, like with Blockstream’s mining operations and others, the CapEx advantages are less important, and we have the additional benefit of lower electricity costs.”

The CoinShares report noted that there has been a major “policy switch” on the part of China’s government, going from listing mining as an undesirable industry as recently as April 2019 to removing mining from this list completely (although bitcoin itself is still illegal).

Still, Mow does not see China’s dominance as a priority issue for 2020.

“Mining in China is still done by individuals and corporations, just as mining in North America or any other location,” Mow said. “Also, the concept of ‘Chinese hash rate’ is misleading because there are non-Chinese individuals and companies mining in China, just as there are Chinese miners in North America.”

How the 2020 Halving Will Impact Bitcoin Mining

For this article, Bitcoin Magazine reached out to a number of bitcoin mining industry leaders and CEOs about their priority issues for 2020. Several mentioned the upcoming Bitcoin halving (or “halvening”), expected in May 2020, as something to watch.

Further Reading: What Is ‘The Halvening’?

“The halving is going to be the most impactful factor to mining in 2020,” Andrew Kiguel, CEO of Hut 8 Mining, said. “All miners should be preparing for what happens and there are several possible outcomes. As the reward drops from 12.5 to 6.25 [BTC], less efficient miners will be forced to evaluate operations.”

Regarding bitcoin mining hardware, the CoinShares report indicated that “going into the reward halving in the spring of 2020, older gear such as the venerable Antminer S9, which is still widely deployed in the network, will likely be approaching the end of its useful lifetime unless the price of Bitcoin rises dramatically, or indeed if more operators gain access to electricity around or below ¢1/kWh.”

The bitcoin mining hash rate will be affected as well. On What’s Halvening, Bendiksen said that if the price of bitcoin stays about the same, “you will see a drawdown in the hash rate of 50 percent” with some companies closing down. But if the bitcoin price doubles, then the hash rate will be back to where it was.

When it comes to the halving and its impact on price, Mow remains optimistic.

“This upcoming halving will see the daily supply of bitcoin drop from 1,800 to 900,” he said. “With overall general awareness of Bitcoin being much higher, and exchange on-ramps being far more mature than four years ago, I’d expect to see a price increase — if not exactly at the time of the halving, then in the months to follow.”

Ultimately, the halving will impact all primary indicators of bitcoin mining in 2020: the equipment used, hash rate and price. But the extent to which the mining industry is affected is still to be determined.

“Will the network hash rate drop significantly after the halving?” Kiguel asked. “I believe it will, as miners using older equipment will no longer be viable. Will the price of bitcoin rally in response to the halving … or is it already priced in? I think we will see a bump in the price, however, perhaps not as high as some are expecting. Perhaps a 50 to 100 percent bump from current levels.”

Naturally, the halving and its expected impact is top of mind for every significant bitcoin miner as 2020 begins.

“In order to maintain current mining economics pre- and post-halving, BTC prices will need to increase substantially, or there will be a dramatic decline in network hash rates as higher cost miners unplug their hardware,” Bitfarms CEO Wes Fulford said. “Bitfarms is well positioned to withstand any short-term volatility in mining economics based on our low cost structure, access to competitively priced electricity and new generation mining fleet.”

Will Mining Technology Continue to Evolve in 2020?

Bendiksen noted on What’s Halvening that the evolution of mining technology is continuing at a pace greater than ever as mining hardware companies like Canaan and MicroBT are competing more closely with hardware giant Bitmain.

And as companies like Canaan and Bitmain apply for initial public offerings in the U.S., the hardware market will become even more decentralized in 2020.

In its report, CoinShares listed the main players in the manufacturing market at the end of 2019 as Bitmain, with its Antminer 15 and 17 series; MicroBT, with its Whatsminer 10 and 20 series; Bitfury, with its latest Clarke chipset; Canaan, with its Avalon 10 series; Innosilicon, with its T3 unit; and Ebang, with its E10 model.

“These new models produce as much as 5x the hashrate per unit as their generational predecessors, which means that even though on a unit-basis, several producers report solid sales of previous-generation models, on a hashrate-basis, Bitmain and MicroBT have delivered the vast majority of new capacity to the network,” according to the report.

It shouldn’t be a surprise that Fulford recognized the importance of using the latest and most efficient technology in 2019, which could set Bitfarms up to have an even more productive 2020.

“We added 13,300 new generation miners which has resulted in a 291 percent increase to computational hash power this year,” he said. “New-generation miners now represent 73 percent of our installed computing power which positions us as one of the most energy-efficient cryptocurrency miners in the public markets.”

Plouton Mining, a pioneering solar energy bitcoin mining company with operations in the Mojave District in California, has a similar emphasis for 2020.

“Throughout 2020 and going forward, we remain focused on running the most efficient hardware and maintaining extremely high power usage efficiency ratios, key fundamentals to maintaining operational profitability,” Plouton CEO Ramak J. Sedigh told Bitcoin Magazine.

But this investment in the latest technology does, of course, depend on the ongoing profitability of bitcoin mining in 2020. To this end, Sedigh explained that his biggest concern is whether bitcoin will be able to maintain a steady price.

“The case for any mining operation, and so the success of the industry, really is dependent on the stability of bitcoin,” Sedigh said. “We plan to survive the extended lows, but we need to keep higher averages so the traditional investors feel confident investing in bitcoin-related projects. To that end, my bigger concern is price manipulation, because at an estimated $150 billion total market cap, bitcoin is easy to manipulate through the exchanges, which contributes to volatility.”

Looking ahead to 2020, bitcoin mining will not be for the faint of heart, as price volatility is still a big unknown, CoinShares reported.

On What’s Halvening, Bendiksen marveled at the risk takers who are prepared to invest billions of dollars into bitcoin mining despite many question marks. Any risk analysis, he said, will tell you it’s a high-risk enterprise and yet, based on the actions of its participants, bitcoin miners clearly have faith in bitcoin and the network.