I am writing this to clarify what I think of Bitcoin. Please pay attention to what I am saying here and not what those in the media are saying I said because this is reliable. I am finding that those who want to promote Bitcoin (which is most people) are characterizing it one way while those who are against it (which are a few scared souls cowering in a corner) are characterizing it another way. As with most things I comment on, the reality has pros and cons and I am trying to be as accurate as possible to communicate what I understand these to be.

To reiterate, as I am not a Bitcoin/cryptocurrency expert, I believe my views are not valuable enough to be relied on so I shouldn’t put them out. I know how much one needs to know in order to have a valuable opinion in the markets, so I wouldn’t bet on my own views. Still, people demand my non-expert assessment of Bitcoin and clarifications in my own words are better than distortions in the media so here it goes, presented with the warning not to rely on it. The only thing I ask of you is that you read what I wrote here rather than pay attention to the sound bites in the media.

I believe Bitcoin is one hell of an invention. To have invented a new type of money via a system that is programmed into a computer and that has worked for around 10 years and is rapidly gaining popularity as both a type of money and a storehold of wealth is an amazing accomplishment. That, like creating the existing credit-based monetary system, is of course a type of alchemy—i.e., making money out of little or nothing. It, like the making of credit that made bankers rich starting with the Medicis around 1350, is making its inventors and those who got in on it early very rich and has the potential to make many more people very rich and to disrupt the existing monetary system. Those who have built it and supported the dream of making this new kind of money a reality have done a fabulous job of sustaining that dream and moving Bitcoin (by which I mean it and its analogous competitors) into being an alternative gold-like asset.

There aren’t many alternative gold-like assets at this time of rising need for them (because of all the debt and money creations that are underway and will happen in the future). Because of what is going on in the world, besides there being a growing need for money or storehold of wealth assets that are limited in supply, there is also a growing need for assets that can be privately held. Because there aren’t many of these gold-like storehold of wealth assets that can be held in privacy and because the sizes of their markets are relatively small, there exists the possibility that Bitcoin and its competitors can fill that growing need. It seems to me that Bitcoin has succeeded in crossing the line from being a highly speculative idea that could well not be around in short order to probably being around and probably having some value in the future. The big questions to me are what can it realistically be used for and what amount of demand will it have. Since the supply is known, one has to estimate the demand to estimate its price.

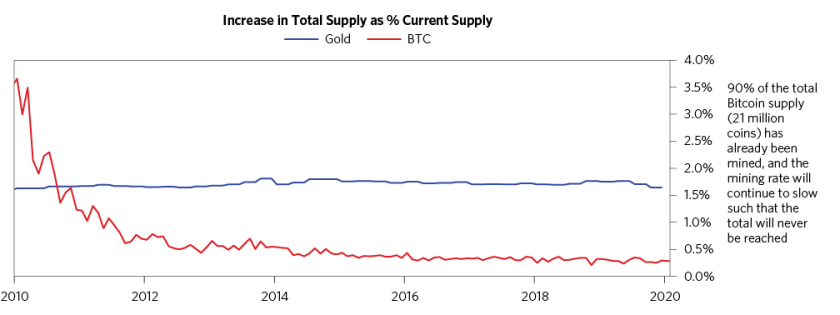

I should clarify what I said about its supply. Although Bitcoin is limited in supply, digital currencies are not limited in supply because new ones have come along and will continue to come along to compete so the supply of Bitcoin-like assets should, and competition will, play a role in determining Bitcoin and other cryptocurrency prices. In fact I assume that better ones will come along and displace this one because that is the way the evolution of everything works—i.e., new ways of doing things and new things always have and always will replace old ways of doing things and old things. Since the way Bitcoin works is fixed, it won’t be able to evolve and I presume that a better alternative will be invented and pass it by. I see that as a risk. For those reasons the “limited supply” argument isn’t as true as it might appear—e.g., if Blackberries were in limited supply they still wouldn’t be worth much because they were replaced by competitors that were more advanced. I still don’t know the answer to why that isn’t a risk, but I would welcome my naïveté being corrected.

At the same time I greatly admire how Bitcoin has stood the test of 10 years of time, not only in this regard but also in how its technology has been working so well and has not been hacked. Still, to one holding digital/cyber assets at a time when cyber offense is much more powerful than cyber defense, the cyber risk is a risk that I can’t ignore. When the Department of Defense can’t protect its systems from being hacked it would be naïve to be totally comfortable that digital assets can’t be hacked, which is one of the advantages of gold-like assets and is one of the risks of all financial assets. In fact I think that there is a good chance that someday we will see the financial system, which consists mostly of digits, be shown to be more vulnerable to disruption and/or to cyber blackmail than is now recognized. By the way, these things are now happening at a growing rate and can threaten the value of traditional financial assets. I am pointing out to you this warning to take or leave as you like. While I recognize that Bitcoin can be held offline via “cold storage,” I understand it is difficult to do and that very few people actually do it. So, by and large, my understanding is that, by Bitcoin being digital and connected, it is not protected against cyber risks to my satisfaction. I look forward to being corrected.

As an extension of Bitcoin¹ being digital are the questions of how private it is and what the government will allow and not allow it to be. Regarding privacy, it appears that Bitcoin will unlikely be as private as some people surmise. It is, after all, a public ledger and a material amount of Bitcoin is held in a non-private manner. If the government (and perhaps hackers) want to see who has what, I doubt that privacy could be protected. Also, it appears to me that if the government wanted to get rid of its use, most of those who are using it wouldn’t be able to use it so the demand for it would plunge. Rather than it being far-fetched that the government would invade the privacy and/or prevent the use of Bitcoin (and its competitors) it seems to me that the more successful it is the more likely these possibilities would be. Starting with the formation of the first central bank (the Bank of England in 1694), for good logical reasons governments wanted control over money and they protected their abilities to have the only monies and credit within their borders. When I a) put myself in the shoes of government officials, b) see their actions, and c) hear what they say, it is hard for me to imagine that they would allow Bitcoin (or gold) to be an obviously better choice than the money and credit that they are producing. I suspect that Bitcoin’s biggest risk is being successful, because if it’s successful, the government will try to kill it and they have a lot of power to succeed.

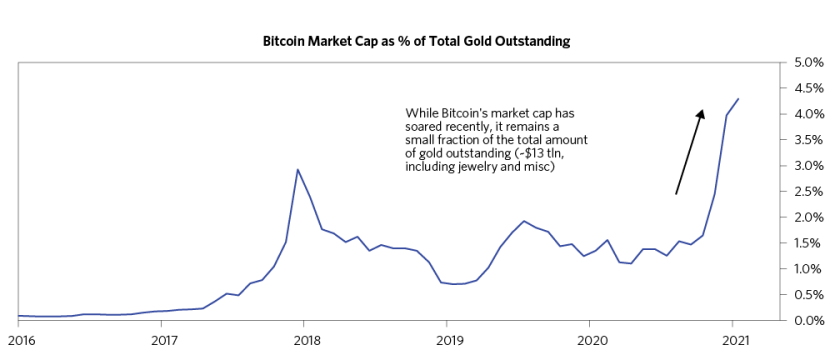

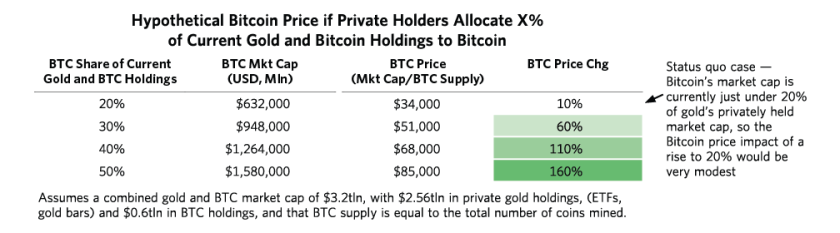

As far as the supply/demand picture is concerned, while the supply is known the long-term demand over the relevant long-term time horizon (because this is a long-duration asset) is tough to know, largely for reasons I mentioned. For example, since I view Bitcoin as being a gold-like alternative asset, I asked Rebecca Patterson and others at Bridgewater to do some calculations to calculate what if the value of private holdings of gold and then take percentages of those holdings and assume they were shifted to Bitcoin to diversify that type of holding. By way of example, what if 10% or 20% or 30 or 40 or 50% of private holdings of gold were shifted to Bitcoin to diversify holdings, or what if 10 or 20 percent of those who built Bitcoin and got on its wagon wanted to diversify into other assets like gold and stocks, or what if the government wanted to prohibit its use, or what if etc… what would these scenarios look like? They paint a picture that is highly uncertain. (You can read the full report below). That is why to me Bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn’t mind losing about 80% of.

That is what Bitcoin looks like to this non-expert. I am eager to be corrected and learn more. On the other hand, believe me when I tell you that I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets.

¹When I use “Bitcoin” please take that to mean Bitcoin and its analogous competitors.

A Look at the Path for Bitcoin If It Is to Become an Alternative Storehold of Wealth

Rebecca Patterson, Dina Tsarapkina, Ross Tan, Khia Kurtenbach

With most central banks around the world acting to depreciate their currencies at a time when bond yields are already converging to zero, it’s reasonable to look for alternative storeholds of wealth. Bitcoin, by far the leader among cryptocurrencies, has gotten the lion’s share of attention here as it has skyrocketed in value—appreciating nearly 200% just since October to more than $40,000 per bitcoin before settling at current prices around $30,000. Bitcoin offers some attractive attributes, such as limited supply and global exchangeability, and is evolving quickly. For now, though, we do not see it as a viable storehold of wealth for large institutional investors, thanks mainly to a high degree of volatility, regulatory uncertainty, and operational constraints. Rather, we see it as more like buying an option on potential “digital gold”—it has a wide cone of outcomes, with one path leading to it becoming a true institutionally accepted alternative storehold of wealth.

When we examine Bitcoin, we believe it shares some but not yet all of the qualities we would consider necessary to act as a storehold of wealth. Certainly, Bitcoin has merit: similar to gold, it cannot be devalued by central bank printing and its total supply is limited. Further, it is easily portable and exchangeable globally, especially for individuals. It also has the potential to provide diversification, though to date this is more theoretical than realized.

At the same time, Bitcoin faces challenges that at least for now could slow broader adoption by institutional investors. We’d highlight three in particular:

- Bitcoin remains an extremely volatile asset, and its future purchasing power remains a fundamentally speculative proposition. Compared to established storeholds of wealth, such as gold, real estate, or safe-haven fiat currencies, Bitcoin faces a much wider range of outcomes in terms of its future value.

- Bitcoin still faces meaningful regulatory tail risks and lacks any of the underlying government backing or deep history that would provide a more fundamental baseline of future demand. While greater regulation might help Bitcoin gain broader institutional acceptance, it could also trigger selling by some of its largest existing owners who prioritize a lack of public oversight around the asset.

- While there have been improvements, current levels of liquidity still constitute real structural challenges to holding Bitcoin for large traditional institutions such as Bridgewater and its clients.

Looking ahead, it’s reasonable to expect the infrastructure around Bitcoin and cryptocurrencies more generally will continue to evolve and mature. In addition, the new paradigm that we are living in, with many government bonds no longer offering the same return or diversification characteristics and currencies facing greater risk of depreciation, could propel development of alternative storeholds of wealth faster than might otherwise have been the case. At this point, though, we want to be balanced in our outlook given the number of factors that will shape Bitcoin’s future—which, for now at least, we would not predict with confidence.

The rest of this research provides thoughts on Bitcoin from three perspectives:

- Its place among cryptocurrencies and factors driving its recent rally,

- Attributes that support a case for Bitcoin to become a storehold of wealth, and

- Questions and challenges for Bitcoin in thinking about its future.

We appreciate that there is a lot of detail here. For those who just want the highlights, we would recommend skimming the bolded text and taking note of the exhibits.

Bitcoin’s Dramatic Rally Is Reigniting Discussion Around Its Viability as a Storehold of Wealth

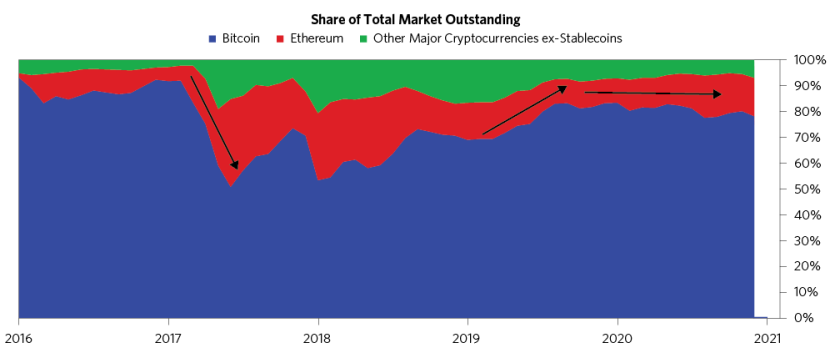

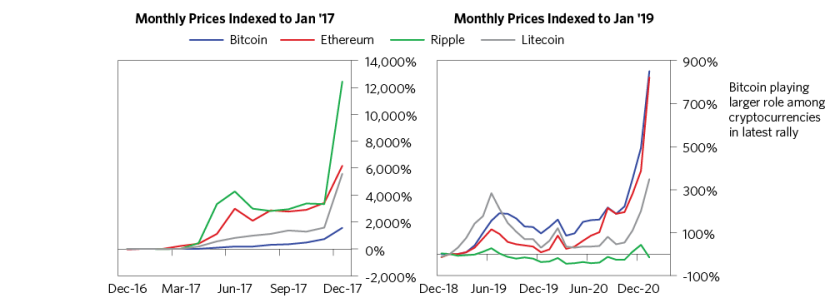

After seeing its price surge by 400% in 2020, Bitcoin is once again attracting attention, fueled in no small part by what many perceive to be its potential to serve as “digital gold”—an alternative store of value and potential inflation hedge for portfolios. While there are a multitude of cryptocurrencies out there now, we are focusing on Bitcoin as it has dominant market- and mind-share around the discussion of a potential “digital gold.”

In the previous 2017 rally, while Bitcoin still enjoyed a heavy amount of direct speculative interest, it saw lower returns and its share of the total cryptocurrency market fell sharply, as a large portion of the overall speculative fervor was captured by a wave of ICOs (initial coin offerings), where speculators bought into new cryptocurrency tokens offered by infant companies promising revolutionary new decentralized technologies and business models. In contrast, in the recent run-up through 2019 and up to the end of 2020, Bitcoin outperformed other cryptocurrencies, with its market share now back to its highest levels since early 2017. The growing interest in the idea of Bitcoin as a “digital gold” seems, based on conversations we have had with leading cryptocurrency market participants and service providers, to be a key driver of these trends.

Finite Supply Makes Bitcoin Especially Attractive at a Time When Central Banks Are Printing Aggressively

Similar to gold, Bitcoin has limited usage as a medium for directly exchanging goods and services. Also like gold, however, Bitcoin offers stable and limited issuance that cannot be devalued by central bank printing. Bitcoin has a hard-coded total supply of 21 million bitcoins, with an issuance rate that automatically halves every few years. It is this feature of Bitcoin that has mainly driven the “digital gold” narrative. As shown below, while Bitcoin’s issuance rate for its first couple of years was initially much higher, its rate of supply growth is now lower than gold’s.

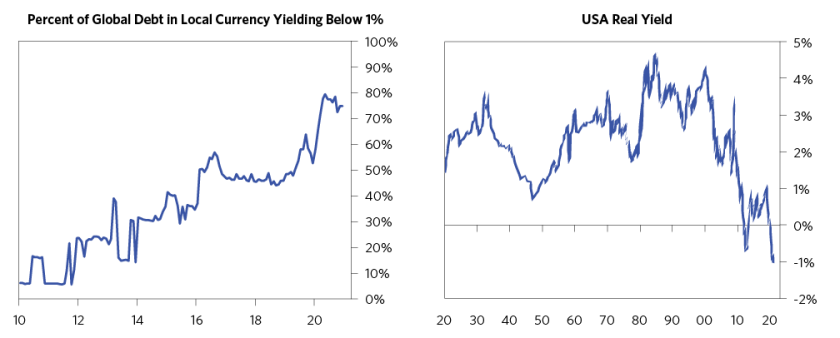

Bitcoin may look especially attractive to some investors now for the same reasons that gold has been supported in the last few years. Neither gold nor Bitcoin pay a yield on an outright basis, but this matters little when yields on other assets have collapsed. And gold is one of the few assets that can do well in stagflation, an outcome likely enough that it should be considered and planned for. Moreover, in the context of high and potentially rising levels of external and internal conflict, gold has the added benefit of not being tied to the outcomes of any one country. If one were to truly accept the idea of Bitcoin as “digital gold,” you could imagine a conceptually similar case being made for Bitcoin too.

Bitcoin Is Globally Accessible and Easily Portable-Useful Attributes for a Storehold of Wealth

Of course, mere scarcity is not sufficient in and of itself to drive demand for an asset and sustain it as a viable store of value. Indeed, there are other cryptocurrencies that may have similar features to Bitcoin and could also conceptually compete as an alternative “digital gold.” However, Bitcoin’s relatively longer history, much larger size, and wider awareness and acceptance have given it a clear advantage, at least so far. For instance, Bitcoin has significantly outperformed Bitcoin Cash, Litecoin, and Monero—other major cryptocurrencies with similar technical features to Bitcoin in terms of having a fixed total supply and an emphasis on ideas of “sound money.” There has also been a strong rise in the use of stablecoins, collateralized cryptocurrency tokens which are pegged, mostly to the dollar. However, stablecoins, by nature of being pegged, are not really an alternative storehold of wealth—instead they are just a new form of digital dollars.

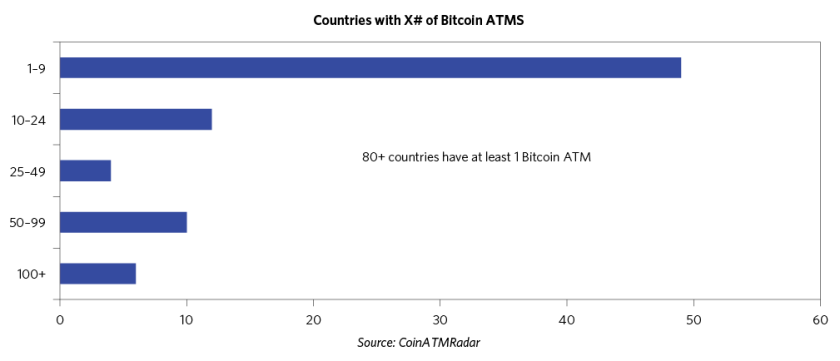

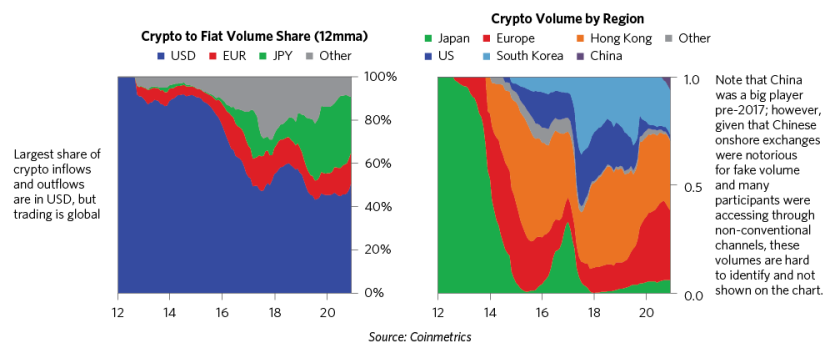

Finally, beyond being able to retain its purchasing power through time, a good storehold of wealth also needs to be easily exchangeable and accessible (both now and in the future). Compared to some other traditional storeholds of wealth such as gold, art, and real estate, Bitcoin is much more easily exchangeable, especially for individual holders. Indeed, given its digital nature, Bitcoin might be the most portable storehold of wealth, much more so than physical cash. And, in terms of its geographic reach, with the global proliferation of Bitcoin exchange services, you can relatively easily cash out Bitcoin in most places around the world, although it is still much easier to convert USD into local currencies (apart from capital controls).

It Remains Unclear If Bitcoin Will Provide Diversification When Portfolios Need It Most

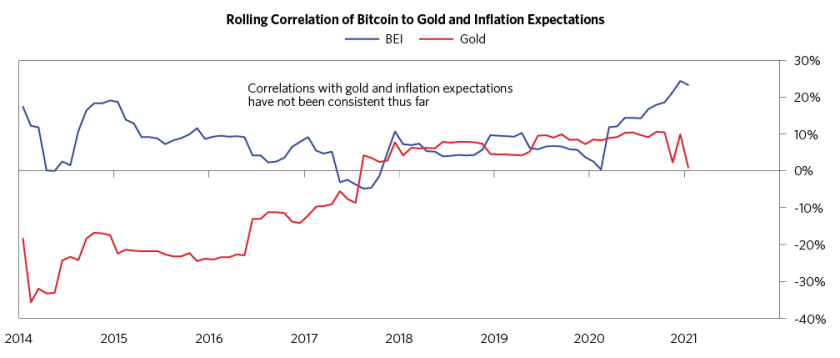

With just over a decade in existence, there is not enough evidence to credibly conclude that Bitcoin, like gold, will reliably offer portfolio diversification in the future. That said, we have still looked at available data to see how Bitcoin would have worked both to hedge against inflation and to offset portfolio drawdowns. As shown below, this year, Bitcoin has generally appreciated alongside rising inflation expectations, but its longer-term historical relationships with inflation and gold have been relatively weak.

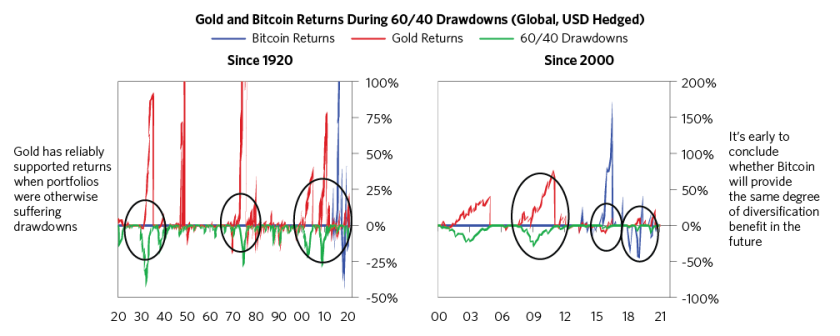

Separately, the charts below show how gold has reliably acted over time to support returns during periods when 60/40 portfolios were otherwise suffering drawdowns. We have zoomed in to overlay Bitcoin’s performance in similar drawdown periods since its inception in 2009. We hesitate to draw any firm conclusions with such a small sample size and given how quickly the cryptocurrency world is evolving. So far, Bitcoin’s ability to offer some diversification benefit seems more theoretical than realized.

Bitcoin Institutional Acceptance Slowed by Volatility, Regulatory Uncertainty, and Still-Immature Infrastructure

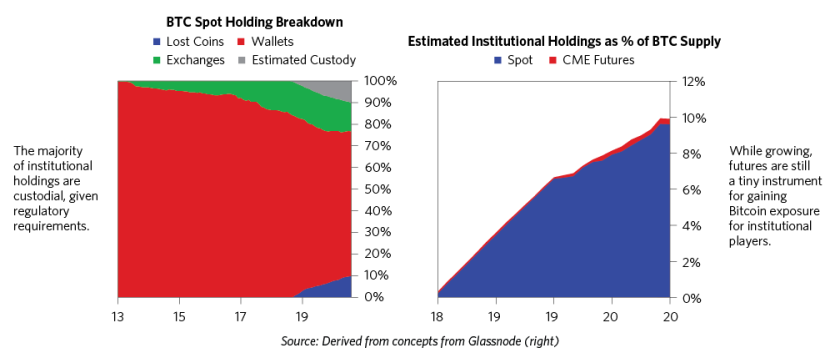

If a fundamental purpose of a storehold of wealth is to preserve or increase one’s purchasing power over time, we think Bitcoin feels more like an option—it remains a highly volatile and speculative asset. Compared to established stores of value, Bitcoin is not yet widely used as a savings vehicle or reserve asset, with no meaningful participation yet by governments or the largest global institutional allocators. Even looking at the recent increase in private institutional participation, a large share still appears to be using Bitcoin for shorter-term speculative trading, rather than as an actual longer-term savings vehicle.

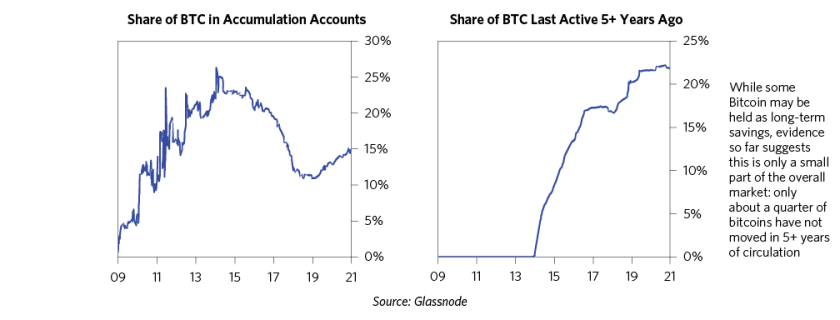

While it is hard to ascertain directly, the charts below show two proxies for the share of Bitcoin used as savings; specifically, the share of Bitcoin in accumulation accounts, and accounts more than 5 years old. Accumulation accounts are accounts that have only purchased Bitcoin and not yet sold any, while “last active” coins are a mix of long-term investors and coins that are likely lost. We see that while long-only players have increased since 2018, their total share remains small (~15%). And, while a decent chunk of bitcoins has not moved in 5+ years (>20%), the majority of supply still looks to be in active or semi-active circulation (suggestive of more speculative trading).

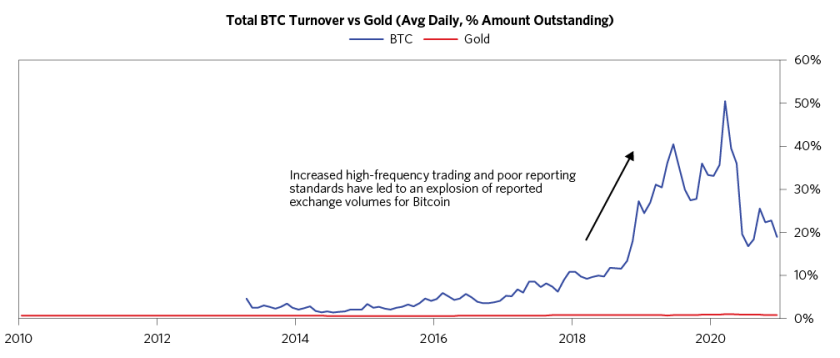

Another way we try to ascertain why Bitcoin is held—whether as a storehold of wealth or for more speculative purposes—is to look at turnover. Bitcoin’s high turnover compared to gold could reflect its relatively more speculative nature. Turnover as a percent of total outstanding is tiny for gold in comparison to Bitcoin, in part as central banks around the world hold a large share of total gold supply as a long-term store of value in their reserves. On the other hand, Bitcoin volumes have exploded in recent years, due to the emergence of high-frequency traders, a booming derivatives market, and a surge of new coins that trade against Bitcoin. This, combined with questionable volume data reported by unregulated exchanges, creates the illusion of increased liquidity. In reality, this liquidity is much more representative of high churn and speculative trading rather than longer-term risk taking.

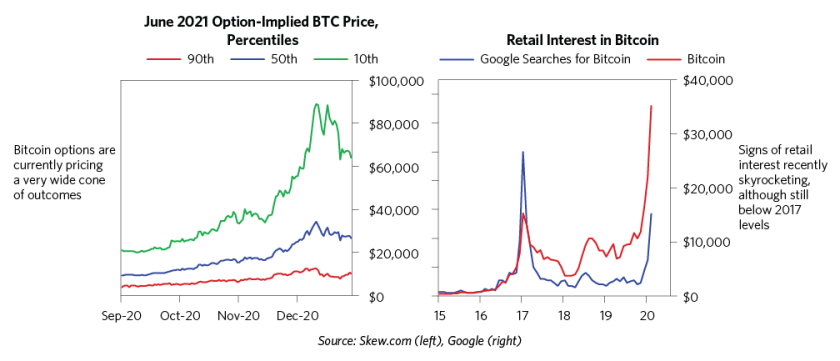

Indeed, the speculative interest in Bitcoin in recent months has increasingly exhibited some classic dynamics of an asset bubble. For example, Bitcoin options are currently pricing a very wide and highly optimistic cone of outcomes for future returns. Discounting very rapid future price appreciation is classic bubble behavior, as we have written about in prior research, and further illustrates how highly speculative the Bitcoin market remains. Further, while this current rally has so far seen less of the frothy, often excessively leveraged, retail buying that characterized 2017’s cryptocurrency bubble, retail interest in Bitcoin has started surging again. Rising margin borrowing rates across the main Bitcoin trading platforms also indicate that leveraged buying is accelerating. The strong discounting of future rapid price appreciation, broad bullish sentiment, and rising leverage are all indications of bubble risk, though as we have written before, bubble dynamics can persist for extended periods.

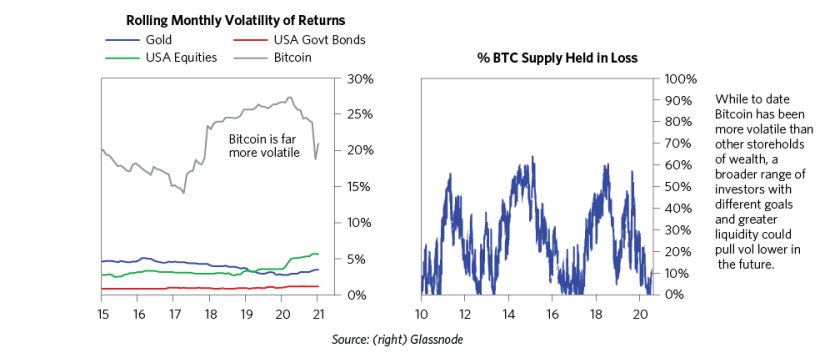

All of the above factors result in Bitcoin’s price volatility being significantly higher than other risky financial assets, like equities and commodities, let alone traditional storeholds of wealth, like gold. At many points already in Bitcoin’s short history, a very large share of total bitcoins have been held at a loss. While there are also times in which the vast majority of bitcoins are held at a profit (as is the case today), sometimes by a significant amount, it is much more important for a storehold of wealth to confidently mitigate against downside risks than to possess speculative upside potential. Again, this reflects the option-like characteristics of Bitcoin today.

While Bitcoin’s realized volatility since inception is higher than what most would consider an established storehold of wealth, we know this could change materially over time. As we have seen in other markets’ evolutions, greater usage by a broader set of investors with different goals and time horizons could pull volatility lower.

Regulatory Outlook for Bitcoin Highly Uncertain; Creates Two-Way Risk

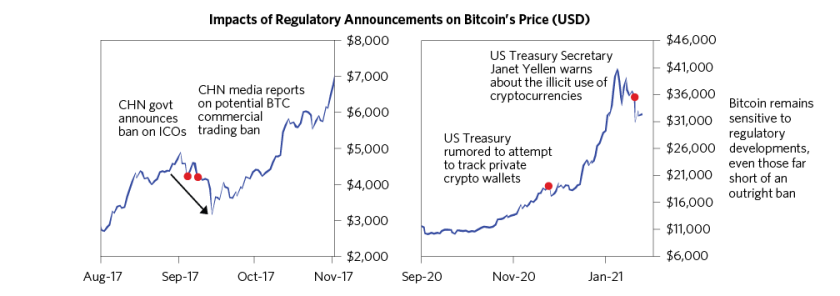

Perhaps more than anything else, Bitcoin’s future adoption by large institutional investors will hinge on regulation. Do policy makers create a regulatory environment that helps garner trust in the asset for some while making it less attractive for others? Do they ban Bitcoin outright? While we do not know how this will evolve, we do know (a) that it is a growing policy maker focus and (b) that there are different paths that could be taken.

On the first point, just this month, European Central Bank President Christine Lagarde noted about Bitcoin that:

“It’s a highly speculative asset, which has conducted some funny business and some interesting and totally reprehensible money laundering activity…There has to be regulations…It’s a matter that needs to be agreed at a global level, because if there is an escape, that escape will be used.”

Similarly, Janet Yellen, during confirmation hearings in mid-January to be US Treasury Secretary, noted that “cryptocurrencies are a particular concern” when it comes to terrorism financing: “We really need to examine ways in which we can curtail their use and make sure that money laundering doesn’t occur through those channels.”

There are two main regulatory paths we think are more likely to play out in the year and years ahead. Either:

- Clamping down on Bitcoin and cryptocurrency usage for fear it could undermine traditional fiat currencies that cuts off further development of this asset in its current form, or

- Creating a regulatory environment that engenders more trust in the asset longer-term but could lead to heightened volatility along the way.

Both paths, in our view, suggest the Bitcoin price roller-coaster ride could continue for some time.

We can see an example of the more restrictive path in China. In September 2017, Chinese authorities imposed a ban on initial coin offerings, a cryptocurrency-based fundraising process, and termed ICOs illegal, triggering an instant 8% decline in Bitcoin prices. A similar ban seems relatively less likely in the US but is technically possible. Given that most Bitcoin purchasers rely on wire transfers and bank debit to move money in and out of Bitcoin exchanges, the US could for all practical purposes make it impossible for US investors to purchase Bitcoin. Our main concern here would be that if there is a future proliferation of central bank digital currencies to serve as officially sanctioned digital storeholds of wealth, governments may prefer to limit the competition posed by Bitcoin as a non-governmental alternative.

Even short of an admittedly unlikely full ban, there are still many potential regulatory developments that could meaningfully hurt Bitcoin’s adoption and market value. The overall US regulatory direction over the past years could be characterized as one of increased acceptance toward blockchain technology and cryptocurrency in areas that are viewed as non-threatening and easily regulated, but with notably increased clampdowns against areas perceived as supporting illicit activity and/or subverting existing regulatory structures.

As an illustration of this dynamic, the Office of the Comptroller of the Currency recently announced that US banks could use blockchains and stablecoins to conduct payments. In contrast, a month earlier, the US Treasury proposed rules that would impede the use of self-hosted cryptocurrency wallets and effectively ban the use of “privacy coins” such as Monero and Zcash.

Given the unregulated “Wild West” landscape out of which the Bitcoin and cryptocurrency world proliferated, there are other areas at risk of disruptive regulatory action. One of the most notable is the status of the largest stablecoin, Tether (USDT). Tether is currently under investigation by the CFTC, US Department of Justice, and New York State Attorney for issuing billions of dollars’ worth of new USDT coins that may not have been fully backed by actual USD as claimed. If Tether were to be shut down or suffer other major regulatory punishment, it could crash the value of all cryptocurrencies, including Bitcoin, given how interconnected the liquidity is across cryptocurrency markets.

A second potential path, along which regulation allows for greater adoption of Bitcoin by more risk-averse institutions, could still lead to major volatility from the largest Bitcoin holders, many of whom were early adopters identifying strongly with the crypto-anarchic principles of Bitcoin’s pseudonymous founder, Satoshi Nakamoto. For instance, the initial speculation around the US Treasury’s proposed self-hosted wallet regulations triggered a meaningful Bitcoin sell-off.

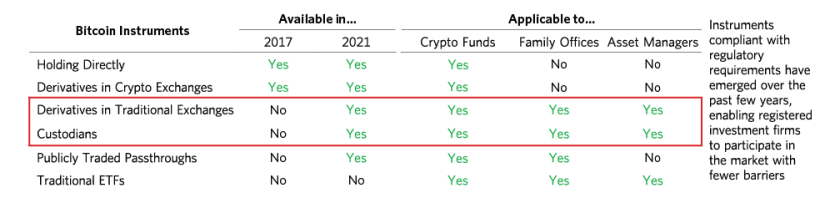

Still, there is a scenario where regulation over the longer term could create some upside worth considering. Compared to the last bull market in 2017, there looks to be greater efficiency, market liquidity, and sophistication in trading infrastructure and custodial solutions now, enabling more institutional participation than before. We believe this is in part thanks to regulatory changes like the acceptance of Bitcoin derivatives on traditional exchanges.

As an outcome of this, recent inflows into Bitcoin have been driven by larger transaction sizes than was the case in 2017, when smaller retail flows dominated. It is worth noting, though, that the extent of institutional participation is still mostly at the level of smaller corporates, hedge funds, and family offices, rather than the larger, traditional institutional allocators, where the market size in relevant instruments remains small.

In a best-case scenario, a maturation of crypto regulation that provides assurances around Bitcoin and greater means to access the asset (such as a Bitcoin ETF) could encourage large institutions to increase their exposure. We wanted to get a sense of what such a shift into Bitcoin might look like—for example, if investors moved some portion of their gold holdings into the cryptocurrency. The table below, which is meant only to be illustrative and is clearly very simple, estimates a Bitcoin price if a certain amount of private gold savings (i.e., not including central banks) were to diversify into Bitcoin. More specifically, in the bottom row in the table, we assume half of the combined market cap of Bitcoin and privately held gold savings is allocated to Bitcoin. Combined, that would be roughly $1.6 trillion allocated across all bitcoins that have ever been mined. Such a shift from gold, diversifying into Bitcoin, could in theory raise the Bitcoin price by at least 160%.

Of course, this calculation assumes there are no issues with liquidity or reflexivity. In reality, our estimates above could prove conservative, as flows of this size could lead to a supply squeeze and reflexivity that drives the actual price of Bitcoin even higher. Again, they are meant more to illustrate a possible dynamic than to suggest any specific forecast. There is clearly much that could influence future price trends of Bitcoin that we might not yet see. For instance, we do not know at what point central banks might consider shifting any of their gold exposure to Bitcoin, or how regulators might respond to these sorts of hypothetical developments in the Bitcoin price.

Structural and Operational Challenges Remain for Large Institutions That Want to Hold Bitcoin

In addition to these potential future regulatory developments, broader Bitcoin adoption is also challenged by lack of sufficient regulatory clarity around operational issues and questions around future resiliency. On the former, while we won’t go into all the details here, to give just one example, institutions have different and generally higher custody requirements; Bitcoin is a bearer asset (i.e., ownership is determined by possession of a private key alone), raising safeguarding and insurance considerations for institutional asset managers. At this point, custody for digital assets is still typically more expensive than for traditional equities, rules for qualified custodians are still being rolled out by regulatory bodies, and the current underwriter market for custodial digital asset insurance is limited. That said, an increasing number of institution-grade custody solutions are slowly being rolled out, and the service and pricing are likely to continue to develop with more demand.

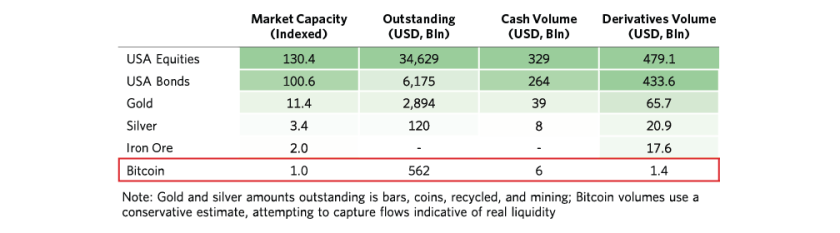

And for large institutions to hold Bitcoin in their portfolios, there also needs to be sufficient liquidity for trades to be conducted in size without destabilizing the market. At this point, while Bitcoin is becoming comparable to some of the markets that Bridgewater trades, it remains small overall despite its liquidity being at an all-time high. We summarize some comparable markets below. For investors able to trade the coin directly, the total market capacity is close to 10% the size of the tradable gold market, based on our assessment of liquidity. For larger asset managers who are only able/willing to access Bitcoin through traditional venues (i.e., derivatives, equity markets), the market size is even smaller.

Below, we show Bitcoin volume from sources we believe are indicative of real liquidity. We see that in these terms, turnover has mostly been flat despite the apparent boom indicated by reported exchange volumes. Given this trend, Bitcoin’s fixed quantity, and small (albeit growing) futures market, Bitcoin’s liquidity today is mostly a function of its price. Despite its recent growth, at its current size, a relatively small number of investors making small shifts in asset allocations could have a big impact on the Bitcoin market. And while the gold market trumps Bitcoin in size, the same is true for gold, which is a fraction of the size of US equities.

Overall, it’s clear that Bitcoin has features that could make it an attractive storehold of wealth; it also has proven resilient so far. However, we have to acknowledge that this financial vehicle is only a decade old. In absolute terms and vis-a-vis established storeholds of wealth such as gold, how will this digital asset fare going forward? Future challenges may still come from quantum computing, regulatory backlash, or issues we haven’t even determined yet. Even if none of these materialize, Bitcoin, for now, feels more to us like an option on a potential storehold of wealth.