Bitcoin. Cryptocurrencies. Smart contracts. Many people have now heard of the rapidly changing ecosystem of financial technology, but few have wrapped their heads around it. Hundreds of central banks and corporations are incubating a game-changing technology called blockchain—and investors are betting billions on it. Yet only 24 percent of global financial services professionals surveyed in 2017 by PricewaterhouseCoopers (PwC) described themselves as “extremely” or “very” familiar with it. Much of the public is unsure if any of this is legal, if they understand it at all. Evangelists say it has the power to upend entire economic systems; others, such as Emin Gün Sirer, a blockchain researcher at Cornell University, warn that while the technical core is “fascinating and disruptive, there’s also a lot of hokum out there.” How to parse the nuance—or get a handle on what a blockchain is?

It all starts with Satoshi Nakamoto, the world’s most reclusive pseudonymous billionaire. In October 2008 Nakamoto published a paper via an obscure Internet mailing list detailing a design for the world’s first blockchain: a public database distributed and synchronized every 10 minutes across thousands of computers, accessible to anyone and yet hackable by no one. Its purpose? To provide a decentralized, bulletproof record of exchange for a new digital currency Nakamoto called Bitcoin.

Until that point, the trouble with “peer-to-peer electronic cash” was that nobody could reliably prevent you from spending it twice. Blockchain technology changed all that by inscribing every transfer of Bitcoin into a “distributed ledger”—a kind of digital spreadsheet that, thanks to the laws of mathematics and cryptography, was more inviolable than carving it in stone. The Economist dubbed it “the trust machine.”

The technology that underpins Bitcoin quickly outgrew it, driving a frenetic period of innovation. Think of blockchain as a scaffolding that can hold any data that need secure provenance: financial histories, ownership documents, proofs of identity. This “worldwide ledger”—as Don Tapscott, co-author of Blockchain Revolution, calls it—is a blank slate. But the technology, imperfect as it is, can be tapped for evil, too, and some are pumping the brakes on the frenzy. Here’s a guide to the digital landscape that Satoshi Nakamoto—whoever he is—has thrust before us.

CORE CONCEPTS

CRYPTOCURRENCY A form of digital currency that relies on the mathematics of cryptography to control how and when units of the currency are created and to ensure secure transfer of funds.

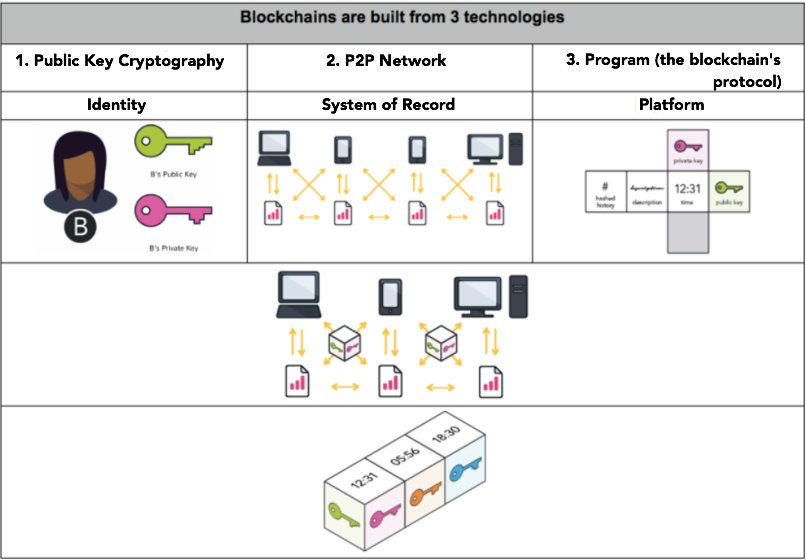

PEER-TO-PEER (P2P) NETWORK A web of computers linked in a decentralized way, such that any computer can communicate directly with any other without going through a central server or other administrator. Napster, the network for sharing music files that launched in the late 1990s, popularized the concept.

NODE A computer connected to a P2P network. The Bitcoin network currently has thousands of nodes spread across the globe.

DISTRIBUTED LEDGER A list of recorded, time-stamped transactions that is simultaneously broadcast, copied and verified via consensus across many different computers in a P2P network. If every node in the network has an identical copy of the ledger, falsified entries or corrupted versions can be easily detected.

BLOCK A grouping of individual transaction records on a blockchain. On the Bitcoin network, new blocks are added to the chain every 10 minutes.

HASHING A cryptographic method that uses a mathematical function to condense any amount of data into a unique string of alphanumeric characters of a certain fixed length—called a hash value. This creates an easily verifiable digital fingerprint for the hashed data. If even a single bit of the original data is changed or corrupted, the fingerprint that emerges from the hash function will be drastically different, making it easy to detect errors or tampering. Hashes are also “one-way”—the data cannot be reassembled or extracted from the fingerprint.

MINING The process by which nodes of a cryptocurrency network compete to securely add new blocks of transactions to a blockchain. Units of the currency are the reward—and hence, a financial incentive to ensure security. Mining involves downloading the latest version of the blockchain’s transactions for verification, then using brute-force computation to randomly search for the solution to a difficult mathematical puzzle created via hashing. The first node to discover the correct solution “mines” that block, adding it to the blockchain and claiming the reward associated with it. Humans control nodes, but the competition has nothing to do with skill: simply, the more raw computing power a miner applies toward the solution, the more likely he or she is to find it—a process called proof of work.