“The horse is here to stay but the automobile is only a novelty – a fad.” So scolded a bank president in 1903, warning Henry Ford’s lawyer not to invest in the motor company. 80 years later, inventor Marty Cooper predicted: “Cellular phones will absolutely not replace local wire systems.” And, 30 years after that, a string of “experts” emerged to dismiss the latest tech – Bitcoin.

See also:He’s Back! Jamie Dimon’s JP Morgan Chase Ponders Bitcoin Futures Move

The Dumbest Bitcoin Predictions Ever Made

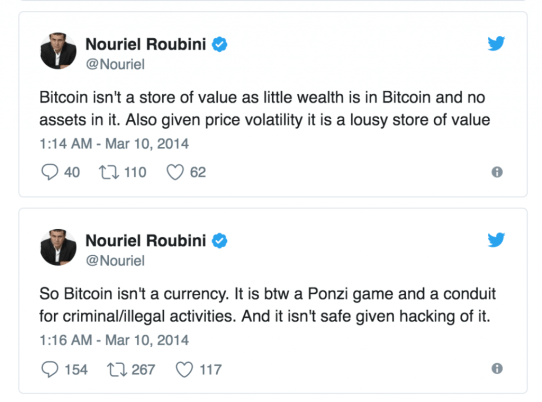

Every disruptive piece of technology attracts its haters and sceptics. Some people just don’t get it, some don’t want to, and others dismiss it out of self-interest. Just this week, former U.S. Federal Reserve chairman Al Greenspan declared: “Bitcoin is not a rational currency.” This is coming from the same man who, in 2011, said: “The United States can pay any debt it has because we can always print money.”

Sometimes, there simply aren’t enough reaction faces. As bitcoin nears the end of a record-breaking year, it seems an appropriate time to revisit the tidings of bitcoin naysayers who were forced to eat their words. Take out the popcorn and get comfortable as we dive into the direst bitcoin pronouncements ever uttered.

Sometimes, there simply aren’t enough reaction faces. As bitcoin nears the end of a record-breaking year, it seems an appropriate time to revisit the tidings of bitcoin naysayers who were forced to eat their words. Take out the popcorn and get comfortable as we dive into the direst bitcoin pronouncements ever uttered.

2011

“So, That’s the End of Bitcoin Then” – Forbes. The publication continues:

[Bitcoins are] not liquid, nor a store of value, as the price collapse shows and if they’re none of those things then they’ll not be a great medium of exchange either as who would want to accept them?…It’s difficult to see what the currency has going for it.

2013

“The Bitcoin Is Dying. Whatever.” – Gizmodo Australia. It reads:

So Bitcoin, we’ll remember the good times, like the time that one guy who got heat stroke while mining Bitcoins. Or the time there was the great heist caper that shut down trading site Mt Gox for an entire day. The lulz were abundant. But frankly, it’s time for you to go. Farewell.

Wired: “[Bitcoin’s] volatility and built-in irreversibility will doom it to the ash-heap of history.”

Business Insider: “Bitcoin is a joke.”

“Beware of This Insidious New Currency Scam” – Salon

“Bitcoin is a really bad idea. Promoting digital currency is like promoting digital food; it will leave you empty and you’ll wonder why you ever thought it was a good idea.” – Zdnet.com

2014

2014 was peak stupidity for writing off bitcoin, as the following soundbites show.

Jason Hoffman, Ericsson vice president: Bitcoin’s blockchain is a good strategy to emulate if “you throw away the actual currency part of it.”

“Bitcoin is neither a relatable store of value nor a helpful unit of account.” – Reuters

John Crudele, New York Post columnist:

Bitcoins are a fake currency that is nothing more than a confidence scheme. Their only value is that there are a few layers of gullible people who are willing to accept them as some form of payment. Eventually this confidence game will end. Go out and buy Beanie Babies instead. At least you can take them to bed at night.

Valley News:

Anyone who thinks that Bitcoin will triumph has to believe that it will succeed where earlier generations of private currencies failed — that Bitcoin will, improbably, manage to overthrow more than a century’s worth of accumulated state power, jealously guarded and ruthlessly enforced. That’s a preposterous fantasy — and a dangerous one, if you’re an investor.

“If Bitcoin was allowed to proliferate as a currency it would produce greater economic uncertainty, reduced trade and lower individual standard of living.” – Business Insider.

“If Bitcoin was allowed to proliferate as a currency it would produce greater economic uncertainty, reduced trade and lower individual standard of living.” – Business Insider.

Ex-Federal Reserve Bank examiner, Mark T. Williams: Bitcoin “will trade for under $10” by June 2014.

Commodities trader Dennis Gartman: Bitcoin is “nothing more than a scam of the first order.” (Three years later and he’s still writing off bitcoin.)

Blogger John Gruber: “In lieu of Bitcoin, I’ve stuck to flushing $100 bills down a toilet. I’m deep in the red, but at least I understand exactly what’s going on.”

Washington Post: “Bitcoin isn’t a currency. It’s a Ponzi scheme for redistributing wealth from one libertarian to another.”

Warren Buffett:

“You’ll be much better off owning productive assets over the next 50 years than you will be holding…bitcoins. It’s not a currency. I wouldn’t be surprised if it wasn’t around in the next 10-20 years.”

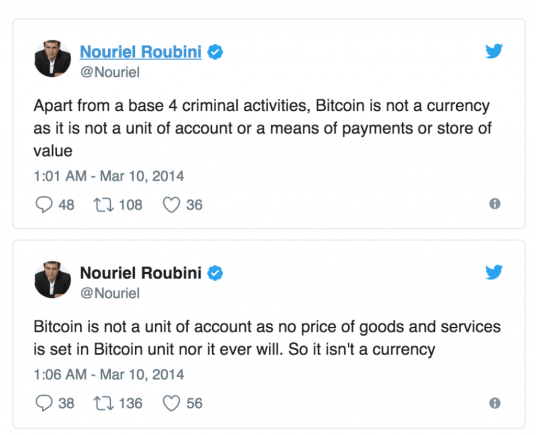

NYU economist and professor Nouriel Roubini:

To anyone seeking an excuse for more popcorn, all of Roubini’s tweets regarding bitcoin are delicious.

2015

“Bitcoins are going to be another dot com bubble burst and they will crash to $1 per bitcoin by the end of 2016.” – r/Markmywords

“Bitcoins are going to be another dot com bubble burst and they will crash to $1 per bitcoin by the end of 2016.” – r/Markmywords

“Bitcoin has peaked and is very unlikely to escalate significantly in value again…It’s basically an elaborate Ponzi scheme.” – Forbes

Jamie Dimon:

There will be no real, non-controlled currency in the world. There is no government that’s going to put up with it for long…there will be no currency that gets around government controls.

“The blockchain does not solve a single problem that anyone, anywhere has – unless you are a criminal and need an anonymous currency to pay or be paid.” – PYMNTS.com

Plata.com:

Bitcoin is a non-thing. It will never be able to have an independent, sovereign value on its own, because it is a non-thing…the Bitcoin is, in fact if not in intention, a fraud; it is an attempt to muscle-in on the enormous scam of universal fiat money, which is a curse upon mankind. And as a scam, it will go to the dustbin of history.

The Guardian: “Spare a thought for the companies scrabbling to jump off the bitcoin ship before it sinks. The currency’s value has been static for months (except for a brief boom and bust in early November when it was caught up in a Chinese ponzi scheme), but perhaps more damningly still, the hype has all but disappeared.”

2016

Taavet Hinrikus, CEO of TransferWise:

Bitcoin, I think we can say, is dead. There is no traction, no one is using bitcoin. The bitcoin experiment, I think we can say, is over.

“R.I.P. Bitcoin. It’s time to move on.” – Washington Post

“Bitcoin was supposed to change the world. What happened?” – Vox

2017

“Bitcoin is a fraud. It’s worse than tulip bulbs.” – Jamie Dimon

“Bitcoin is a fraud. It’s worse than tulip bulbs.” – Jamie Dimon

Two months later: Jamie Dimon’s JP Morgan Chase & Co is “looking at business opportunities in the planned bitcoin-futures market”.

Whatever 2018 brings for bitcoin, it’s sure to be filled with more luminaries writing off the unstoppable digital currency. See you in 12 months’ time for more popcorn, schadenfreude, and sensible chuckles.

Do you think haters will learn to hold their tongues in 2018, or is bitcoin in line for more apocalyptic pronouncements? Let us know in the comments section below.