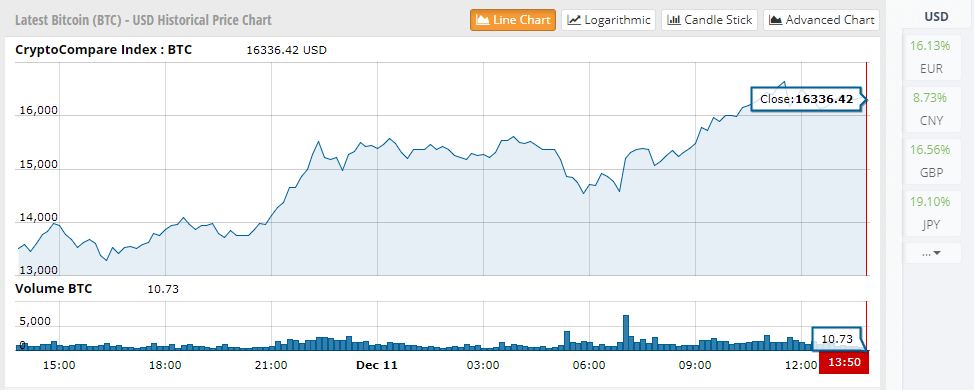

The bitcoin price has surged by more than 20 percent overnight, triggered by the launch of the Chicago Board Options Exchange (CBOE) bitcoin futures trading platform.

According to cryptocurrency market data provider CryptoCompare, the bitcoin price increased from $13,400 to $16,315 within the past 24 hours.

Major Factor: Bitcoin Futures

Major Factor: Bitcoin Futures

Contrary to the claims of several analysts, the listing of bitcoin futures by CBOE, the global finance market’s largest options exchange, has been a driving factor behind the recent bitcoin price suge. Many investors in the market expect the price of bitcoin to increase further in the upcoming months, as tens of billions of dollars in institutional money flow into the bitcoin market.

In an interview with Business Insider, leading cryptocurrency exchange BitMEX business development head Greg Dwyer stated that the price of bitcoin could surpass $50,000 by the end of 2018, as with billions in institutional money, the market valuation of bitcoin will likely reach a trillion dollars in the mid-term.

“Now, looking at the current market cap of bitcoin as going to $300 billion, with more institutional money coming in we could see market caps go up to $500 billion, which could — or even $1 trillion — which could increase the price of bitcoin from now $15,000 up to $20,000, $25,000, or even $50,000,” said Dwyer.

Dwyer also emphasized that the listing of bitcoin futures by the world’s largest and most liquid exchanges such as CBOE, CME, and Nasdaq by the first quarter of 2018 will further stabilize the bitcoin market, allowing it to evolve into a major asset class.

In the long-term, if bitcoin can sustain its current growth rate, the cryptocurrency will compete against existing assets such as gold and penetrate into a multi-trillion dollar industry in offshore banking market, given the endorsement of bitcoin by the traditional finance industry and investors within it through bitcoin futures.

Sharing a similar sentiment as JPMorgan global markets strategist Nikolaos Panigirtzoglou, Dwyer added:

“This is a big endorsement for the digital currency trading space. We could see more flows come into it and also, not only that, but futures help dampen and reduce the volatility of the price. So, this could help stabilize bitcoin as an asset class. And basically increase the utility function of it as a source of economic — as a method of economic transactions.”

What Happens Next?

The entrance of large-scale institutional investors, retail traders, and hedge funds into the bitcoin market will trigger a domino effect across all major exchanges in leading bitcoin markets. The demand for bitcoin within markets such as the US, Japan, and South Korea will increase at a rapid rate, as institutions in the traditional finance sector rush to invest in bitcoin and provide services around the cryptocurrency.

Already, CBOE has started to demonstrate struggles in facilitating the rapid increase in demand for bitcoin from the traditional finance industry. Earlier today, CBOE’s website and its online trading platform were not accessible for several hours, merely within three hours after its listing of bitcoin futures.

In the short-term, the price of bitcoin will likely surge towards $20,000, as noted by Dwyer and prominent investors like Max Keiser and Mike Novogratz.